Where Do Singaporean Consumers Stand On The Financial Well-Being Spectrum?

Even before the onset of the COVID-19 pandemic, Singaporean consumers were already juggling multiple financial challenges, and many felt worried about their financial situation. The pandemic has impacted consumers’ finances further, with many lacking financial resilience and confidence in their financial future.

Financial well-being isn’t just about having a certain bank account balance or amount of investments. It’s about whether people feel confident they can both manage their day-to-day finances and plan for the future. For some people, financial security is about whether they can pay their bills on time or put money aside for an unexpected medical bill. For others, financial peace of mind is knowing they will have enough money to live comfortably until the end of their life.

As financial services firms increase their focus on improving customers’ financial well-being, they’re looking to better understand their customers’ financial needs and develop products and services that can have a positive impact on their financial health and help them achieve their financial goals. Forrester’s Financial Well-Being Segmentation helps firms better assess their customers’ level of financial resilience and attitude toward their financial situation.

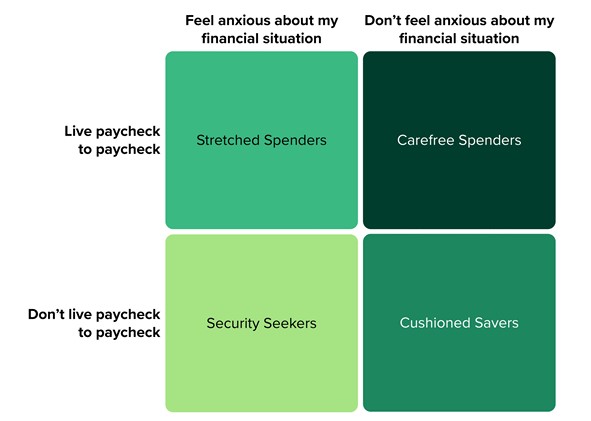

Singaporeans Fall Into Four Distinct Financial Well-Being Segments

To help financial services firms understand where Singaporean consumers stand on the financial well-being spectrum, we surveyed 1,130 Singapore online adults in 2021 and found that:

- Thirty percent of Singaporean consumers are Security Seekers. Security Seekers don’t live paycheck to paycheck, yet they do feel anxious about their financial situation. They cite knowing how to invest, planning for retirement, and managing their finances as their top financial challenges. When asked about how they feel about their finances, 28% say they feel uncertain, while 26% say they feel stable.

- Twenty-eight percent of Singaporean consumers are Carefree Spenders. Carefree Spenders live paycheck to paycheck yet do not feel anxious about their financial situation. The three top financial challenges holding them back are knowing how to save money, planning for retirement, and knowing how to invest. Still, they perceive their current financial situation as stable and comfortable.

- Twenty-five percent of Singaporean consumers are Stretched Spenders. Stretched Spenders live paycheck to paycheck and feel anxious about their financial situation. Their top financial challenges are knowing how to save money, knowing how to invest, and paying for basic daily expenses. Sixty-two percent of them say they feel overwhelmed by debt, and 73% say that debt negatively impacts their ability to pay bills. When asked how they feel about their financial situation, they most often described themselves as being uncertain, stressed, and anxious.

- Seventeen percent of Singaporean consumers are Cushioned Savers. Cushioned Savers don’t live paycheck to paycheck and do not feel anxious about their financial situation. This segment faces few financial hardships. Even so, they still have financial challenges, such as planning for retirement, knowing how to invest, and affording a house. A majority of Cushioned Savers perceive their current financial situation as comfortable and stable.

The higher proportion of Security Seekers is understandable in the current context of uncertainty. In the face of the pandemic and a recession, Singaporeans are becoming more prudent and saving more regularly, with many putting aside emergency funds. COVID-19 has derailed even the best-laid retirement plans. Even for those who are not living hand to mouth and have managed to build savings over time, planning for the future or knowing how to invest is particularly tricky given the economic backdrop.

Firms can map their own customers to these four segments and gain insight into their financial attitudes, behaviors, and interest in or use of specific personal financial management tools, services, or advice. By understanding which segments their customers fall into, financial services firms are better equipped to tailor their financial experiences.

In our upcoming APAC Financial Services Webcast Series 2021, I’ll share how you can build a more relevant segmentation model to improve the financial well-being of your customers. I look forward to discussing this topic with you in my session on 28 July! Register here: https://www.forrester.com/apac/financial-services/

Hope to see you there (virtually)!