The US Customer Experience Index, 2019: Some Small Gains, Widespread Stagnation, No Real Leaders

Small Gains To CX Quality Emerged Amidst Broad Stagnation

Forrester’s 2019 US Customer Experience Index (CX Index™) reveals that the overall quality of the US customer experience rose by an anemic 0.4 points, to 70.2. The report is based on Forrester’s CX Index methodology, which measures how well a brand’s CX strengthens the loyalty of its customers. In this year’s report, we reveal the complete numerical scores of all 260 brands across 16 industries, based on a survey of 101,341 US adult customers.

- Some scores at the brand level inched upward. Although 14% of brand scores rose, 5% of scores declined and a whopping 81% stagnated. Of the brands that posted statistically significant score changes, the size of the gains and losses were about the same — a modest 3 points.

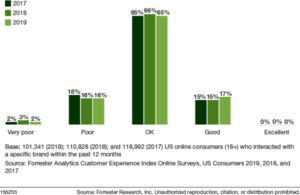

- The number of good scores rose slightly; the number of OK and very poor scores fell. The percentage of scores in the good category increased from 15% to 17%. The percentage of OK scores declined from 66% to 65%, just as the number of very poor scores fell from 3% to 2%.

Stagnation Among Top Brands Means There’s No Real CX Leadership

Not a single brand has managed to rise to the top of our rankings and continue to move upward — the mark of a true CX leader. Instead:

- Elite brands’ scores remained stuck. We refer to the top 5% of brands across all industries in the CX Index as the “elite brands.” Of this year’s 13 elite brands, 11 showed no statistically significant score change, one lost points, and one gained points.

- Most industry front-runners were repeats; nearly all their scores stagnated or decayed. Eleven of 16 industry front-runners were repeats from 2018. No repeat industry front-runner improved in 2019. In three industries, the front-runners’ scores fell. In three of the four industries with new top brands, neither the old nor the new front-runners show statistically significant score changes. The new top brands in these industries earned their spots due only to tiny score variations, not any real change in CX quality.

Without Real Leaders, Only Four Types Of Brands Remain

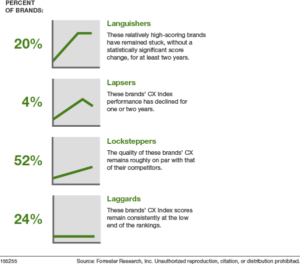

In the absence of real leaders that rise to the top of the pack and continue to improve, there are only four types of brands:

- Languishers: brands that rose high and then stalled. These relatively high-scoring brands have remained stuck, without a statistically significant score change, for at least two years. Overall, 20% of brands in the entire US CX Index are languishers.

- Lapsers: brands that rose and then fell back. Lapsers’ CX Index performance has declined for one or two years. Across the entire US CX Index, 4% of brands are lapsers.

- Locksteppers: brands that move up and down with the pack. Even when these brands improve, they fail to differentiate themselves because the quality of their CX remains roughly on par with that of their competitors. A full 52% of CX Index brands are locksteppers.

- Laggards: brands that have stayed at or near the bottom. Although some laggards have improved the quality of their CX, their scores remain consistently at the low end of the rankings. Overall, 24% of CX Index brands are laggards.

Emotion Holds The Key To Achieving CX Differentiation

Brands that want to break away from the pack should focus on emotion: How an experience makes customers feel has a bigger influence on their loyalty to a brand than effectiveness or ease in every industry. Brand performance in the US CX Index, 2019 reflects this: Elite brands provided an average of 22 emotionally positive experiences for each negative experience, while the lowest-performing 5% of brands provided only three emotionally positive experiences for each negative experience.

To see the rankings of all 260 brands in the US CX Index and a much more detailed analysis of the results — including every brand’s score and the emotions that drive loyalty the most — check out our report: The US Customer Experience Index, 2019.