Forrester Expects A $2.1 Trillion Loss In Retail Sales Globally In 2020

With the ever-changing economic landscape, Forrester’s ForecastView team developed a scenario model to understand the short- and long-term impacts of COVID-19 on the retail industry. Our model examines three scenarios, a base case, best case, and worst case, which estimate retail sales at global and regional levels for the total, online, and offline space.

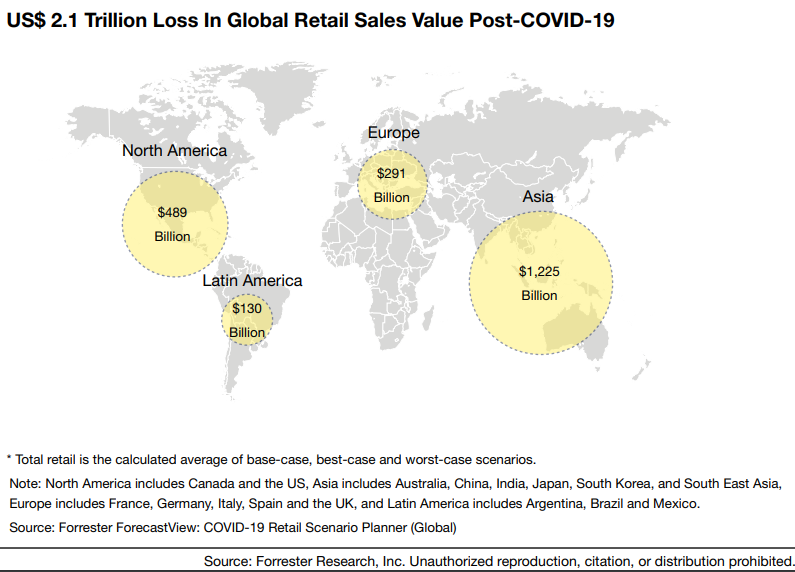

Total retail sales are expected to contract by 9.6% versus 2019. While our scenarios vary in length and severity, on average, we expect a $2.1 trillion loss in retail sales versus Forrester’s pre-COVID-19 forecast. We expect that:

- Offline nongrocery will experience the heaviest losses. As shelter-in-place guidance and lockdowns continue in much of the world, many brick-and-mortar retailers are expected to experience losses. These losses will be most evident for nonessential retailers, as store closures and falling wages will keep consumers from spending money on these types of goods. Globally, we expect to see a double-digit contraction in offline nongrocery sales, with expected sales declines of as much as $2.3 trillion.

- Grocery sales will see strong growth. Restaurant closures and an increase in stockpiling have given way for many essential retailers, especially grocers, to perform well during the COVID-19 crisis. For example, in the UK, grocery sales hit a record high in the four weeks ending March 2020, up 20% from the same period a year earlier. Additionally, in the US, grocery sales grew by 28% in March 2020, with grocery sales as a share of total retail increasing by over 5.0%.

- Growth in online sales won’t offset offline declines. While online spending is still expected to be negatively impacted by the virus, we expect the impact to be far lower than in the offline space. Furthermore, growth in online sales will have a minimal impact in offsetting losses in offline sales, though it is imperative for retailers with an eCommerce arm to manage resources to support online sales during this period.

For more in-depth insights and data surrounding COVID-19’s impact on the retail space, read the full report here.