Little Coordination, Even Less Hunting: External Data Remains Safe In The Wild

A few days ago, I delivered a Forrester webinar on external data: why you need it, how best to find it, and how to effectively buy it.

Take a look at the replay: WEBINAR: Think You’re Doing Data Sourcing Right? Think Again

The premise of the research (and the webinar) is as follows: Decision makers know they need to be insights-driven to create differentiation and competitive advantage. They know their own internal data isn’t enough. In today’s competitive environment, decision makers want to get any insights they can — from any source. And yet, as the use of data spreads across companies — from IT to marketing to sales to operations — data teams can’t keep up with requests for external data. Based on feedback from the audience, we confirmed why.

Webinar Key Takeaways

The webinar provides an overview of Forrester’s guidance for improving external data sourcing and scaling to meet the growing demand. In the presentation, we:

- Discussed how decision makers identify unique sources to give them a competitive advantage.

- Presented best practices in coordinating and scaling data sourcing across the company.

- Introduced the new role of data hunter, specializing in discovering new alternative data sources.

- Gave an overview of the new data landscape, including data types and data sources.

Feedback From The Audience

During the webinar, we asked the audience three questions. We wanted to share the results. The bottom line: Most companies don’t coordinate external data sourcing, and only a third have someone dedicated to finding it. Most continue to rely on more traditional sources or work with originators to create their own.

When asked if they had a formal process for data sourcing within their company, 44% of our respondents said “Yes” while 56% said “No.”

When asked if they had a formal process for data sourcing within their company, 44% of our respondents said “Yes” while 56% said “No.”- When asked if their organization had a “data hunter” role, 33% said “Yes” while 67% said “No.”

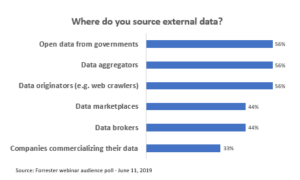

And, finally, when asked where they source external data, many respondents reported that they took advantage of the diverse new landscape. See the results to the right. Newer sources like data marketplaces, “alt data” brokers, and companies that commercialize were less well represented than open government data, data aggregators, and data originators.

And, finally, when asked where they source external data, many respondents reported that they took advantage of the diverse new landscape. See the results to the right. Newer sources like data marketplaces, “alt data” brokers, and companies that commercialize were less well represented than open government data, data aggregators, and data originators.

If you’re interested in seeing more of the research about external data, including how to effectively source it and where to find it, please take a look at Hunting For Fresh Insight? Arm Yourself With Our New Guide To Data Sourcing.

And don’t hesitate to reach out.