New Tech Spotlight: Fintech Investments Reach All-Time High In Q2 2018

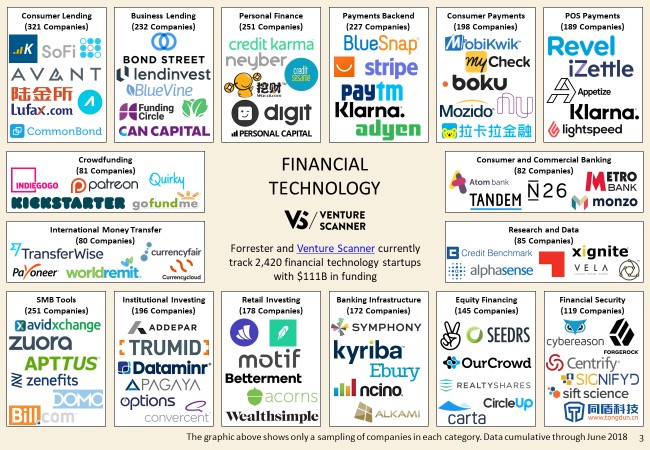

Fintech is white-hot. Venture capital and private equity firms just can’t get enough of it. You’re probably thinking that fintech has been hyped for years now, but Q2 2018 turned out to be the largest quarter of private investment dollars we’ve seen in this category — EVER. Fintech is a parent category of technology that includes about 16 subcategories that address financial business processes such as consumer payments, business lending, institutional investing, and everything in between (see graphic).

In Q2 of this year, fintech startups raked in a total of $19 billion in funding, pushing the overall category to well north of $100 billion in total funding raised. Of all the startup markets we track with our partner Venture Scanner, that cumulative total is second only to transportation tech ($132 billion), which I wrote about in a previous post and in this report on autonomous vehicles.

What’s most interesting to me about the recent spike in fintech investments is that most of it (56%) is attributed to series A and B rounds. This indicates that there’s still a lot of headroom for early-stage companies in what is a very crowded market of more than 2,400 fintech startups around the globe. Looking a bit deeper into this, we found that 79% of this quarterly spike went to companies in the consumer payments space, such as Appetize and One97.

If you’re a Forrester client and interested in fintech, be sure to check out the latest research from some of my colleagues. Oliwia Berdak wrote a great report about how to use fintech to transform your business, and Brendan Miller explored some of the leading companies in payments earlier this year.

Looking for fintech companies or another category of emerging technology? To get started, search for “New Tech” on forrester.com. If you’d like a deeper dive, contact your Forrester account manager.