Prodigal Son Gelsinger Returns As Intel CEO

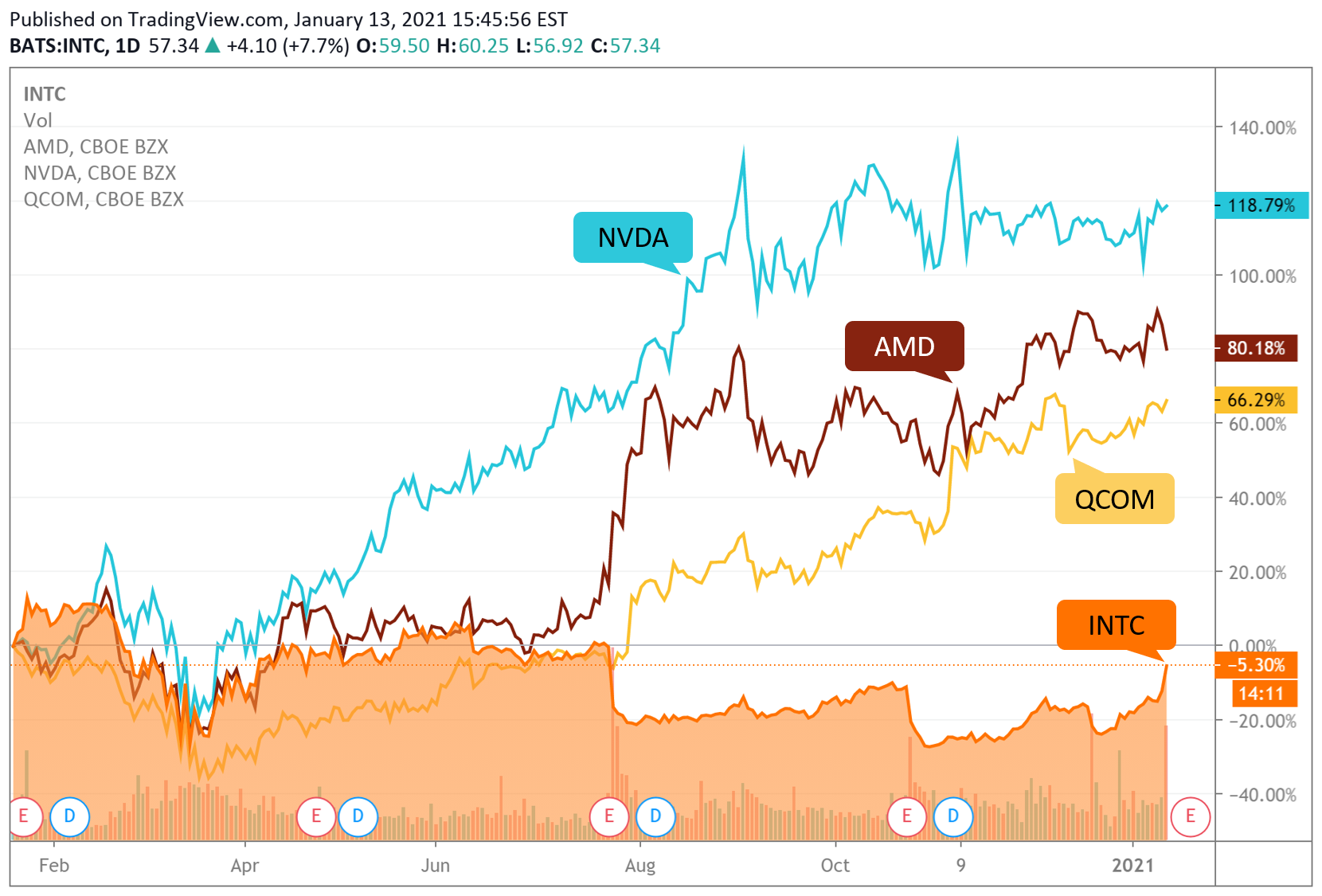

Early today, Intel announced CEO Bob Swan will be replaced by VMware CEO Pat Gelsinger. Facing stronger competitive challenges, Intel has struggled. As you can see, Intel’s stock (INTC) has languished while its peers grew exceptionally well. In the past 12 months, INTC stock lost 5.3% while Qualcomm (QCOM) gained 66.29%, AMD gained 80.18%, and NVIDIA (NVDA) gained an eye-popping 118.79%. Clearly, Intel needs help. It has come under pressure by activist investors to make significant changes. Today brought one such change.

Gelsinger is no stranger to Intel. The first 30 years of his career were in engineering and executive positions at Intel, growing to become Intel’s first Chief Technology Officer and to lead Intel’s biggest business unit. He was a strong contender for CEO before; his eight years at the helm of VMware seasoned him as an effective chief executive.

Intel is an engineering company. It caters to engineers. It sells to engineers. I like Bob Swan, but he is a finance guy. Intel should have an engineer in its top job. Pat is an engineer who proved a savvy CEO. This is a difficult combination of talents, but he has that combo.

Gelsinger’s job won’t be easy. Intel has lost market share; it faces new competition that is stronger than ever and a market that is changing. It offers a wide variety of products; however, its x86 family of processors accounts for a majority of its $72 billion revenue. This is the family under pressure. And then there’s the assault from hedge fund Third Point Management. Pat will have a brief honeymoon period, but he will have to make some big changes quickly. If he doesn’t, his own tenure could be short as well.

The daunting challenges Intel needs to address include:

- A manufacturing dilemma. It suffered an embarrassing miss in delivering on its 7nm process technology. It is sourcing manufacturing of some of its chips to partners like TSMC, but in-house manufacturing has been almost a religion at Intel. Pat will need to negotiate the sticky balance of what is outsourced and what remains Intel IP. This will prove one of his biggest challenges. Supply chain vulnerabilities exposed by the COVID-19 pandemic complicate this strategy. One of Third Point’s big goals is to force Intel to outsource more of its manufacturing. Some outsourcing makes sense, but process superiority can be a competitive advantage for some chips. Forrester believes it should fix its processing issues rather than concede defeat here.

- Lost opportunity in the internet of things (IoT) and mobile. Mobile devices like phones and tablets demand extremely low power consumption on the chips inside — especially the processor. Arm-based designs dominate here and are poised to lead in the burgeoning market for IoT devices. Intel has products here. It is too late to rescue mobile phone potential, but IoT is still anyone’s game. Pat needs to reinvigorate products in this sector to capitalize on IoT growth.

- Rich but risky opportunities in edge computing. Often aligned with IoT opportunities, edge computing is the next big wave of infrastructure. Many of the initial product rollouts from players like Cisco, Dell, and HPE are based on x86 designs because they are often smaller-form factors of existing server designs. A more heterogeneous future is coming, and Intel needs to dominate here to maintain its compute leadership. It also needs to romance nontraditional tech companies like ABB, Johnson Controls, and Siemens. These industrial players will be strong forces in edge computing that will seek partnerships with embedded technology providers like Intel.

- Declining data center volumes and margins. Ignore proclamations of the data center’s demise; however, one cannot ignore the decline we see in data center hardware. Cloud computing stole a lot of this capacity and edge will steal more, but the data center isn’t going away. It is a market almost completely dominated by x86 — and specifically Intel x86 — but lower spending means Intel needs to alter its margins here. If not, AMD will siphon off more of this dwindling — but still huge — market.

- Voracious appetite for high-performance AI compute. One hot area of compute serves the intensive requirements for AI workloads like machine learning and inferencing. The x86 architecture is suboptimal for such demands. In its place, GPUs, so-called XPUs, and even custom processors are gaining traction. NVIDIA has been the big winner here. Pat needs to prioritize investment to gain share in this important high-performance compute market.

- Opportunities abound in programmable processors. Forrester believes composable hardware is a great concept that has been brewing for a few years. Most composable products are system-level rack hardware that can be reconfigured via software models. You change the model, apply it to the hardware, and you have a different server. Custom processors to optimize workloads like AI are coming, but you can’t redesign the silicon for each one. Programmable chips like FPGAs show promise. In the future, you could have a processor optimized to a very specific purpose, and it would be economical with great performance. Pat needs to make Intel the household name for such products.

- Geopolitical tensions. The trade war that erupted between the US and China puts significant pressure on tech vendors in both countries, while all other nations feel caught in the crossfire. The US placed embargos on Chinese technology and China retaliated against American technology. Chinese system-level tech companies like Huawei and Lenovo are struggling with the on-again, off-again sanctions against using US chips. In response, they are trying to develop their own processors. It is an excruciating pursuit, but one that can have immense global implications. Gelsinger will have to contribute to diplomatic efforts aimed at reducing tensions. Intel needs this trade war to cool off.

Despite its woes, Intel remains a formidable powerhouse and arguably still the 800-pound gorilla in semiconductors. With someone like Pat Gelsinger leading the company, it can rebound — once again gaining customer trust and investor confidence. I am optimistic.