The Evolving Face Of ESM

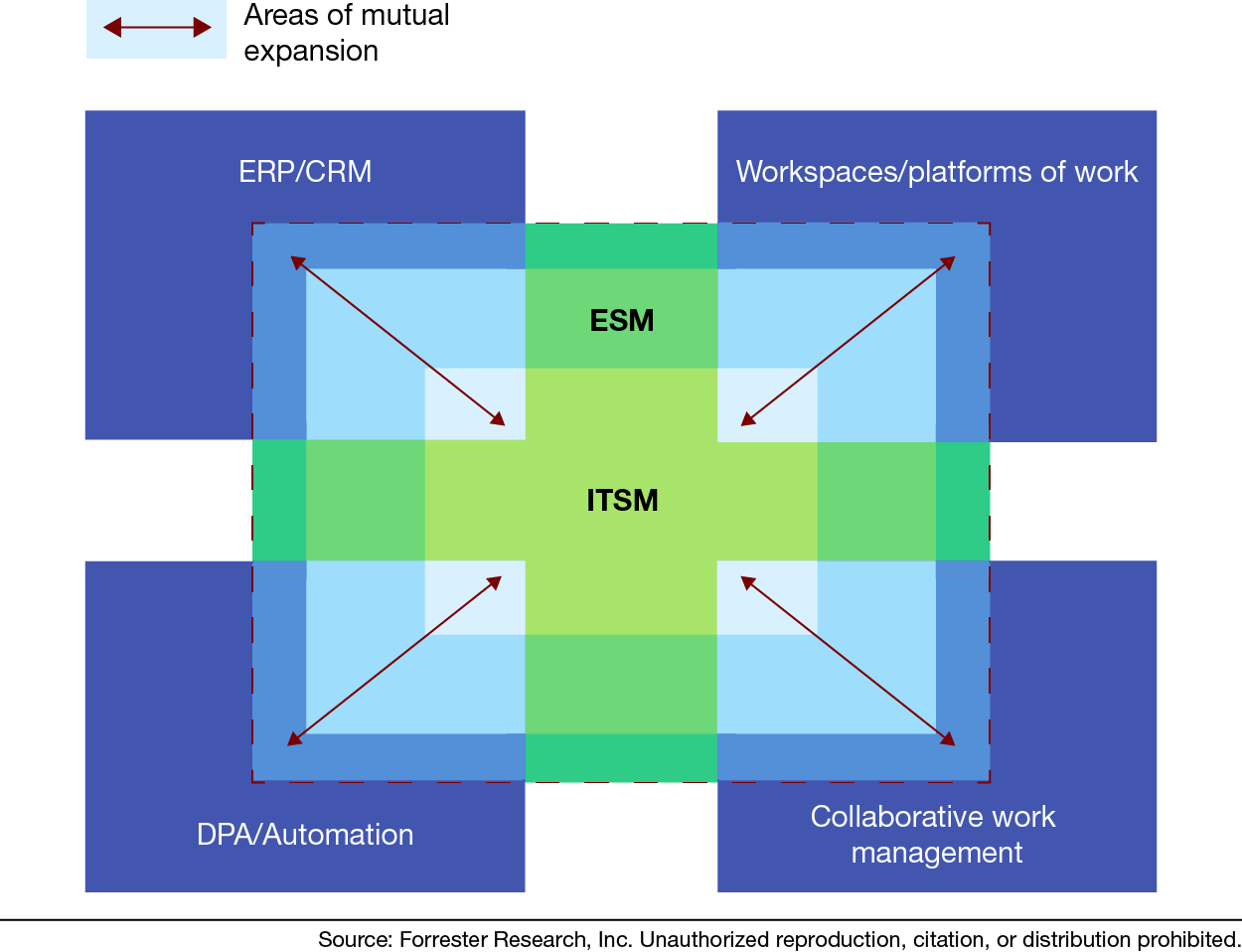

Previously, we’ve written about the gradual competition of large software providers at the edge of enterprise service management (ESM) and the land grab that was taking place. Over the past year, this competition has only intensified. This expansion has been so severe that the actual ESM capability map may evolve.

In 2017, Forrester started covering the “ESM” market, staking this out as an evolution and outgrowth of the IT service management (ITSM) market, where ITSM platforms were being applied outside of IT and for work in HR, facilities, and more. While this is how we still intend to cover this space, especially for the 2021 edition of the ESM Forrester Wave™ evaluation, there is increasing competition not only in providing non-IT workflows/workspaces but increasingly into IT help-desk work and even what we would consider “core ITSM” itself.

There are four main emerging categories of tools further complicating the conversation:

- Help-desk automation solutions, looking to automate fulfillment of help-desk asks through mechanisms such as chatbot-facilitated interactions and issue-avoidance platforms.

- Workspace solutions, looking to provide a centralized place to access role-relevant apps and do “work.”

- ERP/CRM extensions, looking to expand out functionality of enterprise resource planning (ERP) and customer relationship management (CRM) solutions to other domains and provide workflow engines to create business logic and automate processes.

- Collaborative work management solutions, looking to provide a platform for users to create personal and team workspaces and invite other users (internal and external) to collaborate and track digital artifacts.

All four seek to be the new system of engagement or facilitating how work happens in organizations — the same place ESM solutions seek to fill. But this competition isn’t just to provide this central system of work. For example, ESM solutions themselves are encroaching on the core areas of competency — such as CRM — of the organizations behind these new solutions — such as Salesforce.

While there are still large gaps in capability, and true peer competition remains a few years out (and these organizations aren’t even explicitly marketing against each other), these platforms are on an intercept course to compete in the others’ core functionality segments. Already, Forrester clients have begun asking around concerning which solution of the many that they should use that are competing for these edge cases or to function as a digital workspace or digital transformation engine.

Early wins in these core areas — like CRM platforms playing in ITSM and ITSM playing in CRM — will be limited to organizations already heavily embedded with tools in one functional category and missing another. For example, an organization heavily invested in Salesforce and missing an ITSM tool may decide to try Salesforce’s announced ITSM solution over an established ITSM/ESM player. But as capabilities grow, so will competition and the complexity of defining the ESM space.

This is all a very long-winded way to say that we’re sticking with our initial interpretation of the ESM space as the one that is comprised by an outgrowth of the ITSM space but reserve the right to expand this as capabilities of competitors mature.